A Strategic Vantage Point

At Periscope Wealth Management, we pride ourselves on developing and implementing comprehensive strategies to help our clients achieve their goals. To do this, we consider the entirety of the financial life, not just the investment portfolio. Pension decisions, when to take Social Security, estate planning, long-term care options, special needs children, tax-sensitive portfolio management – these are examples of some of the decisions we work hand in hand with our clients to address.

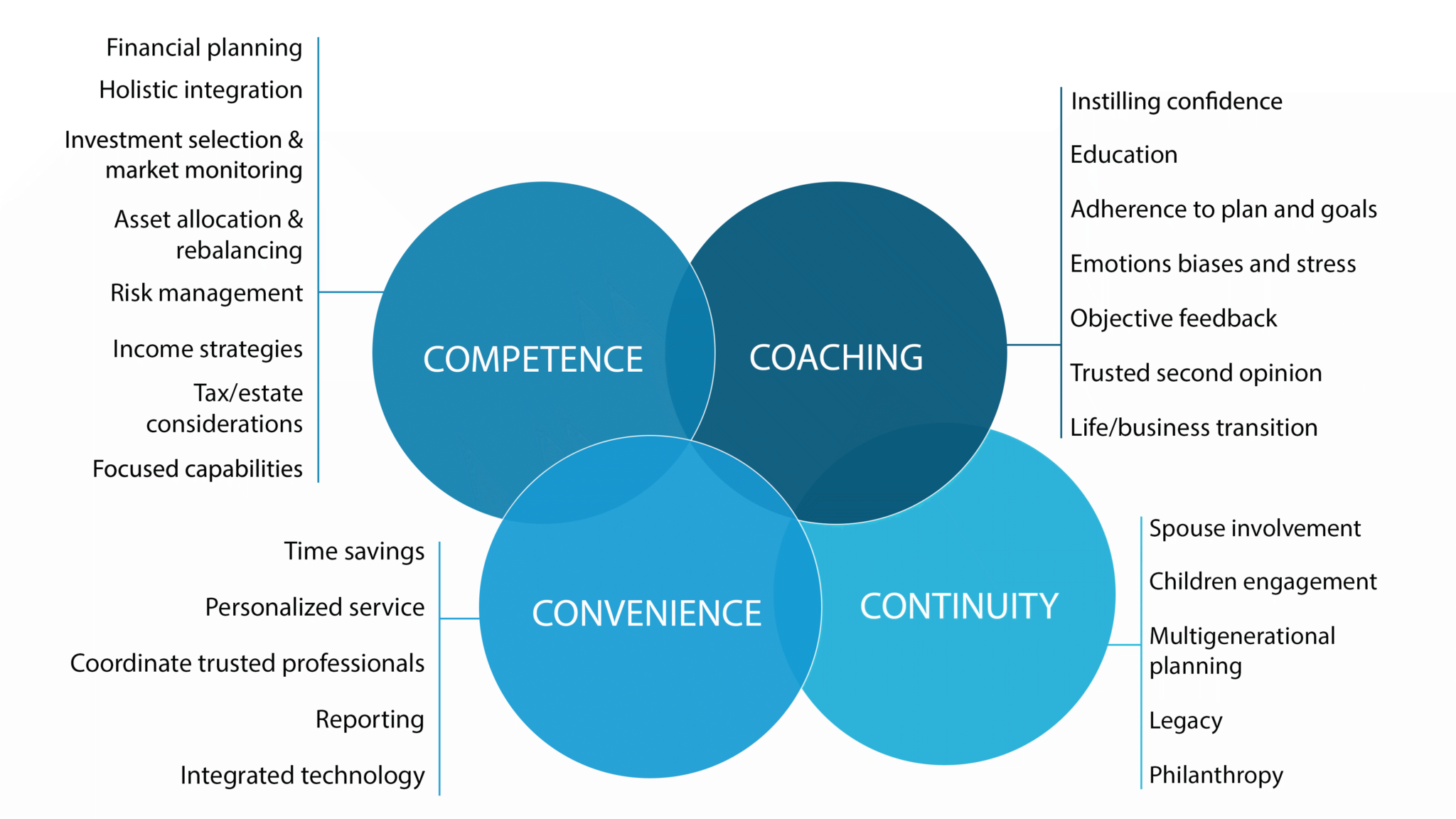

Striving to Provide an

Exceptional Experience

Through Four Deliverables

![]()

Services

Financial success starts with having a well thought out financial plan. Our professionals can help you envision your financial goals, draft a plan to assist in reaching those goals, and help you execute your plan. A financial plan can help you gain confidence that you’re heading in the right direction, help prevent costly investment missteps, save time by not having to constantly revisit your financial matters, and provide confidence that you’re making informed financial decisions. Everyone’s financial plan is different and can cover many specific topics. The most common components of a basic financial plan are:

- Goal planning

- Risk Management

- Retirement planning

- Investment planning

- Cash Flow Assessment

- Tax strategies

- Education planning

- Estate planning strategies

- Reporting and Aggregation Services

Periscope Wealth Management can help create, implement, and monitor a disciplined investment strategy designed to help you progress steadily towards your financial and life goals. The firm’s priorities are our clients and their goals, as we have no allegiance to any money managers, mutual funds, or financial products. Our open architecture investment platform allows us to be completely objective, flexible, and transparent about all aspects of your portfolio. The core of our investment philosophy focuses on embracing market pricing, practicing appropriate diversification, and ensuring that the aggregate portfolio matches your integrated wealth plan. We offer the following services:

Whether you are just starting to save for retirement, preparing for retirement, or already amid retirement we can help. Our qualified Retirement Planning Specialists* professionals can help make sure you are on track, are saving in an efficient manner, and that you get the most from your retirement assets. It’s never too early or late to start formulating or adjusting your retirement plan. Our professionals can help with a wide range of challenges associated with retirement planning including:

We recognize that insurance planning is an important, and often overlooked, element of any integrated financial plan. Financial professionals may neglect this complex, but extremely important component of financial planning. Insurance can help protect you and your loved ones against financial burdens, help you create-tax advantages, and create a self-completing plan. If you already have insurance contracts in place or are just looking for more information don’t hesitate to reach out and leverage our professionals for the following:

Small business owners are constantly juggling many aspects of their businesses on the cutting edge and growing. Periscope’s team can help provide consultation and help you outsource services that are outside the core scope of your business. Our professionals will work to deeply understand your business and provide various services to properly align your benefit, executive comp, and other various financial considerations to your firm’s vision. We encourage business owners to lean on our team for guidance and support for the following matters:

Not associated with or endorsed by the Social Security Administration or any other government agency.

Neither Asset Allocation nor Diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk.

Not associated with or endorsed by the Social Security Administration or any other government agency.

Neither Asset Allocation nor Diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk.